The emergence of NFTs has sparked interest in the digital art industry, leading artists worldwide to look into novel business models for their artistic output. Non-fungible tokens, or NFTs, are unique digital assets that can signify ownership of digital works of art, music, films, and other creative property on the blockchain.

Only the affluent and members of the nobility historically invested in art. However, due to the growing market for NFT art, also known as crypto art, many businesses, auction houses, celebrities, collectors, and investors are joining the party and reaping significant rewards from their investments in crypto-collectibles and other digital assets.

The digital art industry is developing with major technology transformation to allow more inspiring pieces and designs to thrive in the markets. This article will explore the pros and cons of investing in NFT art. You will also learn how to take advantage of the various opportunities in the digital asset industry.

Pros and Cons of Investing in NFT Art

NFTs have been a game-changer in the field of digital art. They provide creators with a cutting-edge means of proving ownership and authenticity of their digital works. NFTs enable artists to tokenize their digital works of art and produce a blockchain-based certificate of ownership that is distinct and verifiable.

Pros

- Allows artists and creators to monetize their creations

NFT creators, including artists, musicians, entrepreneurs, and other innovators, can profit from their digital products and earn royalties for secondary sales while retaining ownership rights. This has completely changed the market for digital art, giving creators a new platform to demonstrate and monetize their skills while simultaneously providing consumers with authenticity and provenance.

- Great investment opportunities

Art collectors and investors can also discover rare pieces from talented artists and buy them to get significant investment returns. For instance, traditional artist Trevor Jones transitioned into crypto art in 2019. EthGirl, a digital painting of an animated collage of the Ethereum logo that exposes a face, was his debut NFT creation. The original price of the NFT artwork was 70 Ether (ETH), which was equal to $10,000 at the time. The artwork was valued at nearly $8 million in 2021, two years after it was created, due to the NFT buzz.

- Safe, secure technology

NFT is based on a secure blockchain technology that ensures digital asset transparency, security and immutability. Each NFT has a special ownership certificate that is recorded on the blockchain and confirms the legitimacy and ownership of the related digital asset.

Cons

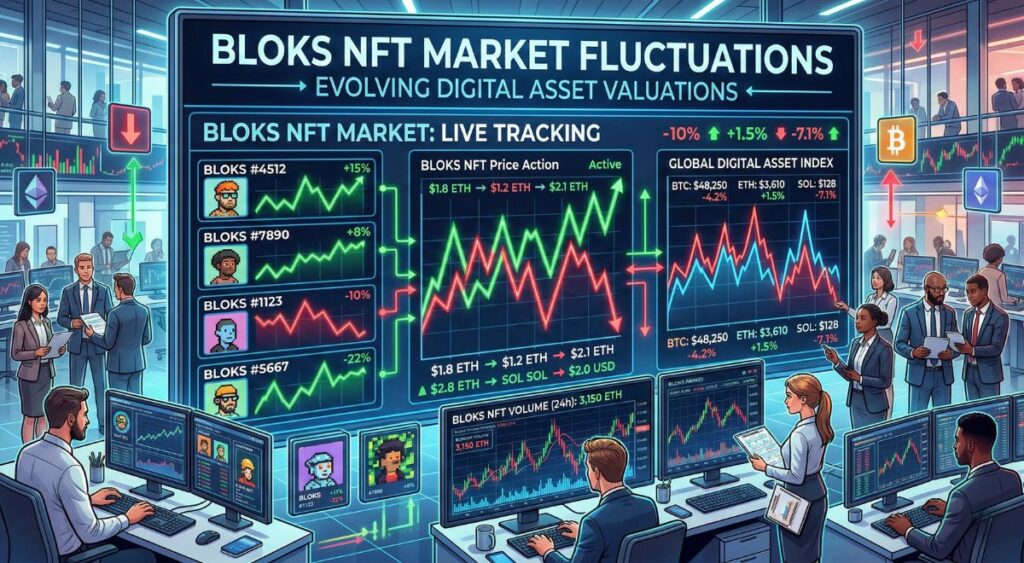

- Volatile market

Before investing in NFTs, you should research the market well. The principle of demand and supply determines the value of a digital asset. The market value of an art piece can drop one day and rise the next.

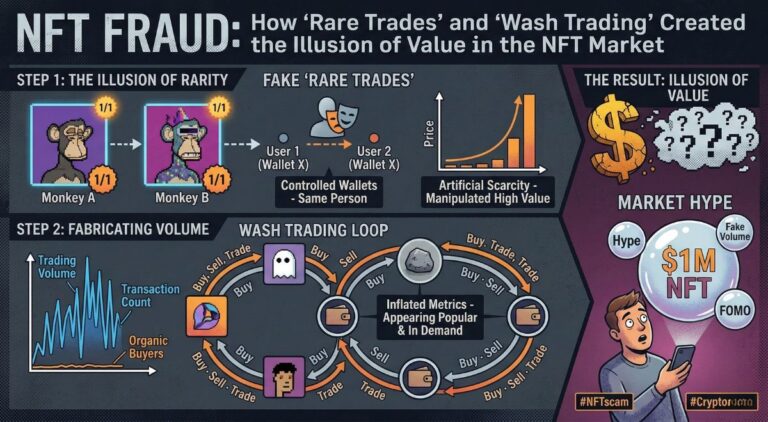

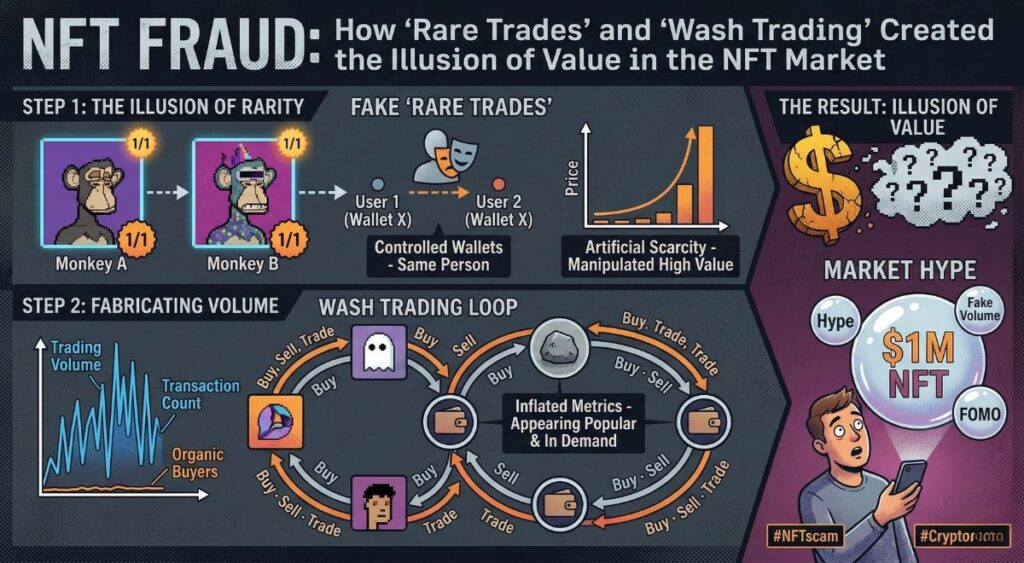

- High prevalence of fraud

Not all NFT marketplaces are reliable, and many cheap imitators are roaming the market. When trading digital art, you can consider legit platforms like Rarible, Cryptopunk NFT, OpenSea, and Foundation.

- Minting costs are expensive.

NFT art collectors and creators must pay minting costs, (gas fees) to secure their NFTs on an Ethereum Blockchain. In addition, minting prices are not only expensive, but they can also be damaging to the planet.

Conclusion

In conclusion, NFTs have altered how we see and use digital assets. NFTs have positioned themselves as a driving force in the future of the digital economy because of their implications for intellectual property rights, evidence of ownership, and worth in the millions of dollars.